Research: Icon unveils changing face of commercial banking in North America

Ovum Report: Real-Time Payments Key Driver for $3.3 Billion Rise in Technology Spend by North American Commercial Banks

50 percent of U.S. and 40 percent of Canadian banks to increase investment in real-time payments as a platform for service innovation in the context of open banking

London, 5th December 2017 – Icon Solutions, a leading provider of technology solutions and real-time payments expertise, launches new research the changing face of commercial banking in North America

New research from Ovum, the market-leading research and consulting firm, reveals that North American commercial banks are continuing to increase their investment in real-time payments (RTP). The report “The rise of real-time payments in North America”, commissioned by Icon Solutions is based on responses from more than 7,000 CIOs and other senior IT decision makers. The study shows that while implementing RTP infrastructures later than global peers, U.S. and Canadian institutions are looking beyond the basic implementation of new payment rails. Instead, banks are also investing in services such as artificial intelligence (AI) and mobile banking based on real-time account data, recognizing that RTP is an important strategic opportunity ahead of open banking.

Research Highlights:

- North American commercial bank IT spending set to increase by $3.3 billion growing to $17.1 billion per year by 2021

- 50 percent of U.S. and 40 percent of Canadian banks plan to further increase investment in RTP systems on a year on year basis

- Spending on RTP cited as top three priority by 25 percent of U.S. institutions and 20 percent of Canadian institutions

- Wider investment in ACH and wholesale payment platforms is also set to increase with 40 percent of US and 20 percent of Canadian banks set to boost spend

- Banks also investing heavily in AI, mobile banking and open APIs, underpinned by RTP infrastructure, to enhance services, differentiate and prepare for open banking

In the short term, banks are investing in real-time services ahead of market adoption to effectively compete for the business of their commercial clients. In the long term, RTP infrastructure will become the foundation for banks transitioning into an open banking environment.

David Bannister, Principal Analyst at Ovum and author of the report, said: “The move to RTP infrastructures has its roots in consumer banking, but commercial banks will also be affected by the changes. Many have undertaken significant investment to be able to comply – 28 percent of US commercial banks are increasing their spending on this area by more than 6 percent in 2018 – but the more far-sighted are also looking beyond basic compliance towards what product and service enhancements they will be able to develop for their corporate customers.”

“They also recognise that real-time infrastructures are part of wider structural changes in the sector and are investing in APIs to address the gathering momentum of the move to open banking.”

A foundation for service innovation

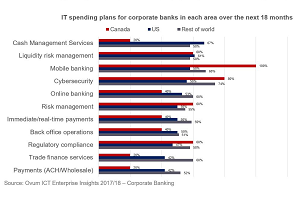

The top areas for IT investment – cash management services, liquidity risk management, mobile banking and on-line banking – are all underpinned by RTP as a foundational capability to address various existing service limitations.

Cash management services – a top priority for corporate customers – is consequently a major focus for investment. For U.S. institutions, real-time cash positions top the list, with 44 percent stating this within their top three priorities, along with direct integration with clients’ ERP or treasury systems. Canadian banks are also prioritising real-time cash forecasting (40 percent) along with a single view across bank relationships (40 percent), for their commercial clients.

Real-time commercial banking

In terms of client-facing services, banks, desperate to break from the stuttering world of batch processing, must implement RTP to unlock real-time transaction data and unleash a powerful wave of real-time services.

For institutions in the US, access to real-time information, analytics and other services based around transaction data is paramount. In Canada, the focus is concentrated more heavily on providing access to RTP, along with enhanced services via digital interfaces.

Open banking and payment convergence

Canadian commercial banks, and to a lesser extent US banks, similar to those across the rest of the world are taking steps to prepare themselves for open banking. All Canadian, and 56 percent of U.S. institutions are embracing an API strategy, with 80 percent and 56 percent respectively planning to integrate third party services into their propositions.

Both banks and third parties need access to real-time customer information to deliver compelling offerings. The investments being made in RTP and open banking imply a future convergence of commercial and retail payments as banks look beyond traditional payments systems.

James Methe, Senior Vice President, North America at Icon Solutions, said: “The strategic investment in the deployment of advanced RTP capabilities beyond core payments systems provides an opportunity for banks to widen their service offering to corporate clients. This research also highlights how adoption of real-time payments is imperative in the face of a rapidly changing landscape that requires banks to be more agile to in the face of widespread systemic change.”

The research “The Rise of Real-time Payments in North America” is available for download.

About Icon Solutions

Icon is an independent award-winning payment and specialist technology provider serving global financial institutions. From IT strategy, architecture and design, to project delivery and software development, Icon enables institutions to rapidly capitalise on the latest innovative technology and market drivers to reduce costs, boost revenues, and ensure compliance with regulatory and industry standards.

The critical value Icon offers its clients, is the combination of deep subject matter expertise in instant payments, a proven track record in delivering bank critical systems, and a FinTech approach to the use of technology. This is evidenced by many longstanding client relationships with leading global financial institutions.

About Ovum

Ovum is a market-leading research and consulting firm focused on helping digital service providers and their technology partners thrive in the connected digital economy. Through its 150 analysts and consultants worldwide, it offers expert analysis and strategic insight across the IT, telecoms, and media industries. Founded in 1985, Ovum has one of the most experienced analyst teams in the industry and is a respected source of guidance for business leaders, CIOs, vendors, service providers, and regulators looking for comprehensive, accurate, and insightful market data, research, and consulting. With 23 offices across six continents, Ovum offers a truly global perspective on technology, communications and media markets and provides clients with insight including workflow tools, forecasts, surveys, market assessments, technology audits, and opinion.

Ovum is part of the Business Intelligence Division of Informa plc, a leading business intelligence, academic publishing, knowledge and events group listed on the London Stock Exchange.

Media Enquiries

Icon Solutions

CCgroup for Icon Solutions

Michele McDermott-Fox

T: +1 905 379 1893